Last week, The Wall Street Journal published my review of a little show up at the New Britain Museum of American Art: paintings by Otis Kaye. Kaye (1885-1974) is not very well known–in fact, that’s how I began my review. I commend the New Britain museum for taking the show, which was organized, oddly enough, by James M. Bradburne, the departing director of the Palazzo Strozzi in Florence.

Last week, The Wall Street Journal published my review of a little show up at the New Britain Museum of American Art: paintings by Otis Kaye. Kaye (1885-1974) is not very well known–in fact, that’s how I began my review. I commend the New Britain museum for taking the show, which was organized, oddly enough, by James M. Bradburne, the departing director of the Palazzo Strozzi in Florence.

Bradburne had learned of Kaye when the Palazzo Strozzi presented Art and Illusion, a survey of trompe l’oeil from antiquity to the present, in 2009 (which I wrote about here).

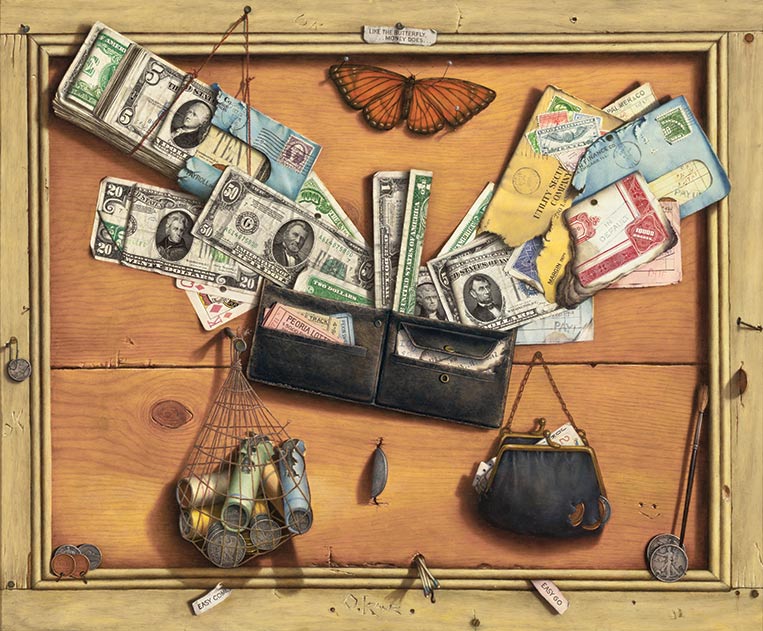

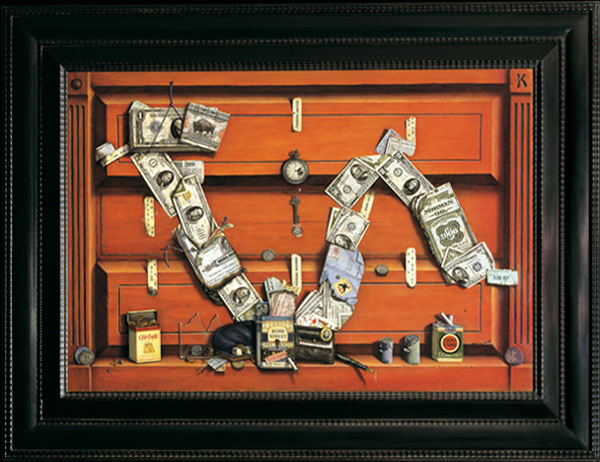

The New Britain museum knew there’d be little or no name recognition, but no matter. In today’s environment and drive to get people in the door, it was taking a chance. Someone gave the exhibit a title that may, or may not, help:Â Otis Kaye: Money, Mystery, and Mastery. His subject was money.

Here’s a link to my review.

Kaye is an odd duck and but for his proficiency in painting he might be categorized as an outsider artist. He certainly didn’t mix in the art world and he painted mostly for himself.

…Kaye told and retold the story of his life in trompe l’oeil. Every work is filled with visual puns, one-liners, and clues to the events that marked—and often scarred—his life. For Kaye, each painting served as a comment, a moral statement, a catharsis, a reflection, and a reconstruction of a chaotic, capricious, and seemingly immoral world in which everything could be bought, sold, and lost in a continuing game of chance.

Museumgoers who typically speed through galleries spending a few seconds looking at a picture will miss Kaye’s genius. But, anecdotally, people seem to get that. While I was in New Britain I watched people spend several minutes with some of his paintings. I overheard comments like “All of these images seem to tell a story†and “there’s a lot in this painting.†It is true, too, that the public tends to like trompe l’oeil paintings; they are fun to view.

I describe some elements of a few paintings, including the two I’ve posted here (D’-JIA-VU? at top and Easy Come, Easy Go below), but there’s usually more in each and every one of the works. For example, in the comparatively simple Nickel Dime Securities (also described in the review), I had to leave out that a ticket he painted promises “ON THE LAST OF OCT. 1929 / $1.00 / NORMAN OIL CO / WILL PAY TO / THE BEARER / MAYBE IF WE / HAVE MONEY / $1.00 DOLLAR.” That date is two days after the ’29 crash on Wall Street.

You just have to keep looking.

Ok, Kaye is not a master artist. But he is a good one and should  be better known.

There’s another reason to like the NBMAA (which I’ve both criticized and praised in the past) and I’ll be back with pictures of that reason in the next day or so.

Photo Credits: Courtesy of the New Britain Museum of American Art