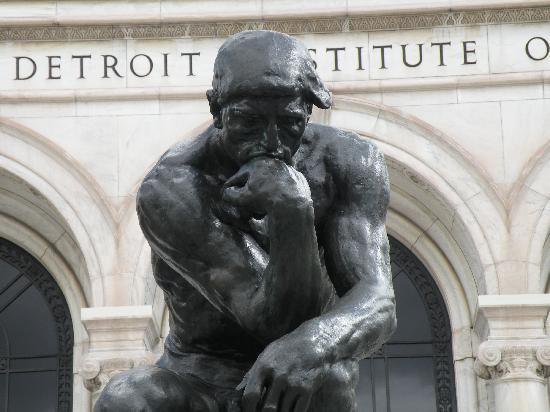

Mark Stryker, a staff writer at the Detroit Free Press, picks up today on my Tuesday post about Christie’s vulture behavior, and adds:

Some other art world insiders, who declined to speak on the record to the Free Press because of the sensitivity of the situation, privately characterized Christie’s actions as predatory. They noted the company was risking possibly alienating other museums, which buy and sell work through the major auction houses all the time.

Both Christie’s and Sotheby’s declined to comment to Stryker, but he found another auctioneer who would:

Joan Walker, a partner at the Detroit-based DuMouchelle, a respected regional auction house, was adamant that if DuMouchelle were asked to participate in a forced sale of DIA art, the company have nothing to do with it.

“We are completely against the sale of any works at the museum,” Walker said. “Our treasures should be kept at the museum for the enjoyment of the public, and I think the city should find a solution in other areas.”

Asked to comment directly on Christie’s sending appraisers to Detroit, Walker said curtly: “That’s up to them.”

Here’s the link to the Freep’s story.