There’s more gold in the annual art investment report from Skate’s, Part 2. (Comments on Part 1 are here.) And it involves what the market is saying about individual artists.

First some context: In its survey, Skate’s included sales from 30 auction houses around the world, and concluded that “throughout 2011 the art market has resisted pervasive global economic turmoil and instability, with its high-end segment growing on every measure in 2011 compared to 2010.”

First some context: In its survey, Skate’s included sales from 30 auction houses around the world, and concluded that “throughout 2011 the art market has resisted pervasive global economic turmoil and instability, with its high-end segment growing on every measure in 2011 compared to 2010.”

As I said the other day, more than 2,000 art works sold for more than $1 million last year; now this report says that 721 works sold in 2012 for more than $2.1 million, the figure that vaulted a work into the Skate 5000, the world’s most valuable art works according to auction house records. Those 721 lots were created by 250 artists, 81 of which were new to the top 5000 hit list.

With those numbers out of the way, let’s look at some of the artists in the report. Skate’s analysis goes beyond the top prices of the year (although they are in the report, too) to more interesting items.

Who are the ten “most liquid” artists, for example, with the highest number of repeat sales in 2011? You can probably guess that Andy Warhol is at the top (9 last year), but who’s next? Monet, Picasso, Richter and Basquiat, in that order. Then Calder, Leger…etc. (See the report.)

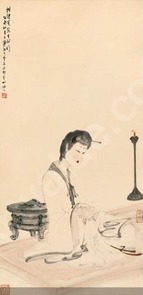

Which art work sold last year earned the greatest return? Skate’s says it was Lady in Solitude (above) by Fu Baoshi (who will soon have a show at the Metropolitan Museum,* coming from the Cleveland Museum of Art and opening on Jan. 21). Someone bought Lady three years ago for $262,830 and sold it last year for more than $1.9 million, an annualized investment return of 93.82%.

Works by two other Chinese artists came next, Zao Wou-ki and Chu Teh-Chun, followed by Richter and Polke. I don’t think one can extrapolate much from those five examples, except perhaps that some people are cashing out of Chinese art. Skate’s does note, though, that this is Richter’s second consecutive time with a top five return, both for abstract works from the same period.

The lack of liquidity in art shows up in the five works with the lowest rate of return: by Lichtenstein, Warhol, Cranach the Younger, Wesselman and Hesse. Lichtenstein’s Still Life with Mirror, purchased last May for $5.8 million, had been bought for $9.6 million three years before — a big loss.

The lack of liquidity in art shows up in the five works with the lowest rate of return: by Lichtenstein, Warhol, Cranach the Younger, Wesselman and Hesse. Lichtenstein’s Still Life with Mirror, purchased last May for $5.8 million, had been bought for $9.6 million three years before — a big loss.

But none of the works in this category had been held for more than 4 years, which was probably the cause of the loss — not necessarily the quality of the picture. Were they fire sales? Perhaps a longer holding period would have led to a return.

Skate’s calculates the top ten losers by looking at artists whose works — many works and works losing much value — were forced out of the top 5000. One can see trends here. Both number and value lists are topped by Renoir, followed by Monet in numbers and Pissarro in value. Of living artists, Damien Hirst figures in both lists, probably cheering David Hockney.

But not for long. Who, according to Skate’s, are the most valuable living artists? In order, the top ten are Richter (his record-setter, above), Koons, Johns, Hirst, Zao, Prince, Zhang, Doig, Zeng, and Ruscha. Freud and Twombly fell off because of their deaths.

One can make too much of this kind of analysis — but we won’t. To me, it’s just fun and somewhat fascinating to use analytical tools on art. Take a look — these are just the highlights; there’s more.

Photo Credits: Courtesy of Sotheby’s (top) and Bui Gallery (bottom)

*I consult to a foundation that supports the Met.