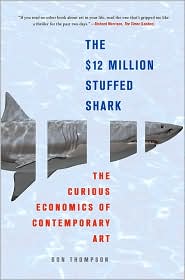

When Don Thompson, a marketing and economics professor in the MBA program at York University, Toronto, published his view on the art market, The $12 million Stuffed Shark, in 2008, it garnered a couple good reviews, but was ignored by some art publications and mainstream media. He sketched much of his analysis in terms of brands — branded artists, branded dealers, branded museums, branded auction houses, etc. Some of it seemed right to me, some seemed off-the mark. Last month, the paperback version was published.

So on the eve of the bellwether spring contemporary art sales, I went back to Thompson for Five Questions. Curiously, Thompson doesn’t list the book on his C.V.

So on the eve of the bellwether spring contemporary art sales, I went back to Thompson for Five Questions. Curiously, Thompson doesn’t list the book on his C.V.

As for his answers – well, they weren’t entirely satisfying, either. See what you think:

1) What have you learned about the art world in the three years since the book was first published? What did you get wrong?

The market crash came faster and more dramatically than anyone foresaw, triggered by the 2008 financial market meltdown. I thought there would be a period of flat price levels for contemporary art, followed by a gradual decline. I also thought the prices of museum quality art would hold up, because so many new museums around the world were bidding. Turned out that selling prices for museum quality art fell 20-30%, against 40 – 50% for most of the contemporary art market.

2) If I knew nothing about art and read your book, I’d come away thinking that it’s all a hoax — is that what you intended?

It is not a hoax, there are properly described art works, and willing sellers and buyers. It is just that values are based on intangibles, not always the intrinsic quality of the work.

3) Do you think the markets/the economics, of other categories of art — Old Masters, Impressionism, national art, etc. — are more legitimate, and why is that so or not so?

The economics of earlier schools of art often differ from contemporary in two ways. The standard test of “it takes two generations to determine the lasting value of art” has been met, and there is the factor of scarcity, following the death of the artist.

4) Tell us a little about the reaction you received from readers — and was it different in

Reader reaction to the book has been good both in

5 If the contemporary art market is as crazy as you describe it — based on so many “intangibles” — do you see any ways to make it more rational, more related to the intrinsic value of the art?

The market is not crazy, and buyers are not irrational. Buyers are simply responding to a different set of motivations than you and I might – plus they have a great deal more money. Last [week] (May 4th), a 1932 Picasso brought a record US$106.4 million at Christie’s in

Put differently, assume the price was four months income for the buyer. Lots of people pay four months income for a painting they love and want to live with. Those people just earn less than the buyer of the Picasso.